The OCS Governors Coalition supports measures that thoughtfully expand OCS energy production. In order to meet this objective, the Coalition strongly believes that the following four policies can increase OCS development in a sustainable manner that better benefits coastal states.

- Ensure a consistent, efficient permitting regime

- Expand Areas Available for Offshore Energy Development

- Expand Revenue-Sharing for Interested States

- Update OCS Resource Evaluation and Knowledge

Consistent and Efficient Permitting Regime:

For operators on federal lands and waters, the average approval wait-time can be several times longer than the wait-time for a similar permit on private or state-owned land. Statistics show that the average approval time for a plan in the Gulf of Mexico was 110.6 days in July 2012, up from an historical average of 61 days. Even more so, operators off Alaska have experienced permit and plan approvals that can take years.

Conversely, state agencies generally take much less time to approve permits and plans for development on private and state lands. While the average wait-time varies from state to state, anecdotal evidence from states including North Dakota, Ohio and Colorado shows that permitting at the state level can take as little as 10 to 27 days.

In order to accelerate the pace of permitting and ensure lessees are afforded with consistent, timely permits and plan approvals, the offices charged with reviewing these applications – principally the Bureau of Ocean Energy Management, the Bureau of Safety and Environmental Enforcement, the Environmental Protection Agency, and the National Oceanic and Atmospheric Administration – must receive adequate resources. Furthermore, regulators must provide operators with clear guidelines and expectations for applications to minimize or eliminate the time spent by regulators seeking additional information or clarification.

Expand Areas Available for Offshore Energy Development:

According to the federal government, the U.S. OCS contains an estimated 89.87 billion barrels of undiscovered, technically recoverable oil and 327.49 trillion cubic feet of undiscovered, technically recoverable natural gas. Moreover, shallow areas in Atlantic, Eastern Gulf of Mexico and the Pacific have been identified as showing strong potential for offshore wind development.

Despite these vast resources, many of these areas remain closed to exploration and production due to federal policies that restrict access. According to experts, even after over 50 years of OCS exploration and development, 70% of total resources are yet to be discovered. Of this, more than half of this potential exists in areas of the Outer Continental Shelf outside the central and western Gulf of Mexico.

With then-Interior Secretary Sally Jewell’s approval of the Proposed Final Five-Year Plan for Oil and Gas Leasing for 2017-2022 in January 2017, the Department decided not to open access to Alaska’s Beaufort and Chukchi Seas and any new frontiers for the next five years, including in the Gulf of Mexico and the Mid- and South-Atlantic. The decision foregoing lease sales in the Mid- and South Atlantic and Alaskan Arctic came despite strong bipartisan support from state and congressional officials for inclusion of their regions in the program. The exclusion of these areas in this five-year plan means that, barring the development of a new leasing plan or an Act of Congress, exploration of these rich offshore areas will not proceed until at least 2023, if not later.

Areas of particular interest include:

- The Mid- and South Atlantic: Mean estimates of undiscovered technically recoverable resources (UTRR) resources are 2.82 billion barrels of oil and 26.41 trillion cubic feet of gas;

- Eastern Gulf of Mexico (parts are under Congressional moratorium until 2022): Mean estimates of UTRR are 3.63 billion barrels of oil and 11.49 trillion cubic feet of gas; and

- Alaskan Arctic (Beaufort and Chukchi Seas): Mean estimates of UTRR are 23.6 billion barrels of oil and 104.41 trillion cubic feet of gas

In July 2017, Interior Secretary Ryan Zinke launched the development of a 2019-2024 National Outer Continental Shelf Oil and Gas Leasing Program, through which the federal government will consider the addition of areas not included in the 2017-2022 program.

The OCS Governors Coalition is pleased with the progress in advancing offshore wind development in many areas. Existing leases off the North and Mid Atlantic coast and future leases in additional areas will play an important role in providing renewable electricity to coastal states and furthering energy diversity and security for coastal communities. The Coalition believes that resource evaluation and leasing has been successful thus far due in part to the level of coordination between the states and the Bureau of Ocean Energy Management on leasing and development decisions. Tasks forces developed and executed in states such as South Carolina and Virginia in many ways exhibit the type of communication and coordination that should occur with all offshore energy development decisions.

The OCS Governors Coalition strongly believes the federal government must expand opportunities for offshore energy development. Rising global demand for energy requires that the United States proactively pursue development of American resources – both traditional and renewable – to minimize dependence on foreign energy. Furthermore, states must have a more active voice in determining whether areas off their coasts are available for energy development.

Expand Revenue-Sharing for Interested States

Currently, offshore revenue-sharing as provided under the Gulf of Mexico Energy Security Act (2006) only extends to the four states (Texas, Louisiana, Mississippi and Alabama) included in the original legislation. Alaska, Virginia, North Carolina and other states that are either developing offshore resources or are exploring the potential are not provided revenue-sharing under current law.

Revenue-sharing is provided for onshore energy development and in many energy-producing states it provides significant funds to state and local governments. The Coalition believes this disparity is unfair and does not properly account for the fact that states hosting offshore development bear costs associated with OCS development. As the chart below exemplifies, for states like Alaska, the disparity between onshore and offshore revenues can be significant:

Federal Oil & Gas Royalty Payments to the State of Alaska

| Federal Acreage | Share of Royalties to State of Alaska | Share of Bonus Bids and Rents to State of Alaska | Total Federal Disbursement to the State of Alaska in 2010 |

| Arctic National Wildlife Refuge | Mineral Leasing Act of 1920 provides for 90% of royalties to the State; ANWR leasing legislation proposes 50%-50% split; final amount will be negotiated. | Bonus bids and rental sharing mirror the royalty sharing agreement. | $0.00 |

| Offshore (3-6 miles) | 27% | No sharing of bonus bids and rents with the State. | $5,800,000.00 |

| Offshore (Beyond 6 miles) | No royalties to the State at this time. | No sharing of bonus bids and rents with the State. | $0.00 |

| National Petroleum Reserve-Alaska (NPR-A) | 50% | 50% of bonus bids and rents. | $3,840,000.00 |

| Other Onshore Federal Lands (Cook Inlet) | 90% | 90% of bonus bids and rents. | $14,240,000.00 |

* The year 2010 was chosen as it is representative of most recent years’ revenue disbursements.

**In 2010, the State of Alaska and local governments in Alaska received a combined $37 million pursuant to the federal Coastal Impact Assistance Program (CIAP). The program provided a portion of OCS revenues to select oil and gas producing states and local governments only from 2007-2010 to mitigate the impacts of such oil and gas activities.

As the federal government examines opportunities for expanded energy development outside the western and central Gulf of Mexico, all U.S. states should be afforded the opportunity for revenue-sharing. This revenue can help state and local governments fund coastal conservation and hurricane protection as well as fund other critical state services. The Coalition strongly supports legislative efforts to expand revenue-sharing equitably to all offshore energy-producing states. Moreover, the Coalition supports legislative efforts to lift or increase the $500 million revenue-sharing cap in order to provide states a fair share of revenues generated.

Update OCS Resource Evaluation and Knowledge:

In deciding whether to pursue offshore development off their coasts, states must have an up-to-date assessment of the potential resource base off their coasts. With many offshore areas closed to exploration, accurate estimates of oil and gas reserves in many areas do not exist.

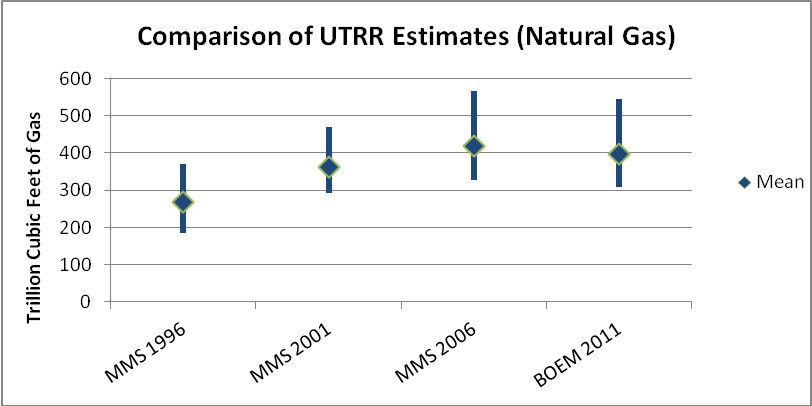

For areas outside of known, explored oil and natural gas fields, the federal government relies on various geophysical, geological, technical and economic studies to estimate potential reserves in frontier areas. Concurrent with advances in knowledge and technology, assessments of the amount of undiscovered technically recoverable resources (UTRR) have typically increased with each evaluation. As the chart from the Bureau of Ocean Energy Management demonstrates, in the four evaluations over a 15-year span between 1996 and 2011, estimates for UTRR of oil nearly tripled.

The OCS Governors Coalition believes expanded evaluation of offshore areas – in particular those currently not open to oil and gas exploration and production – is necessary for policymakers to make informed decisions about the economic and environmental goals of offshore energy policy. Having current resource assessment information would also allow more effective communication between federal and state officials regarding resource potential and offshore energy policy.

To this effect, the OCS Governors Coalition supports funding the Bureau of Ocean Energy Management’s Resource Evaluation Program. For OCS planning regions where robust data does not exist, the Coalition also supports seismic testing and exploration in order to better understand the potential size and value of the resource base.